Unemployment tax calculator 2023

Tax calculations allow for Tax-Deferred Retirement Plan. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

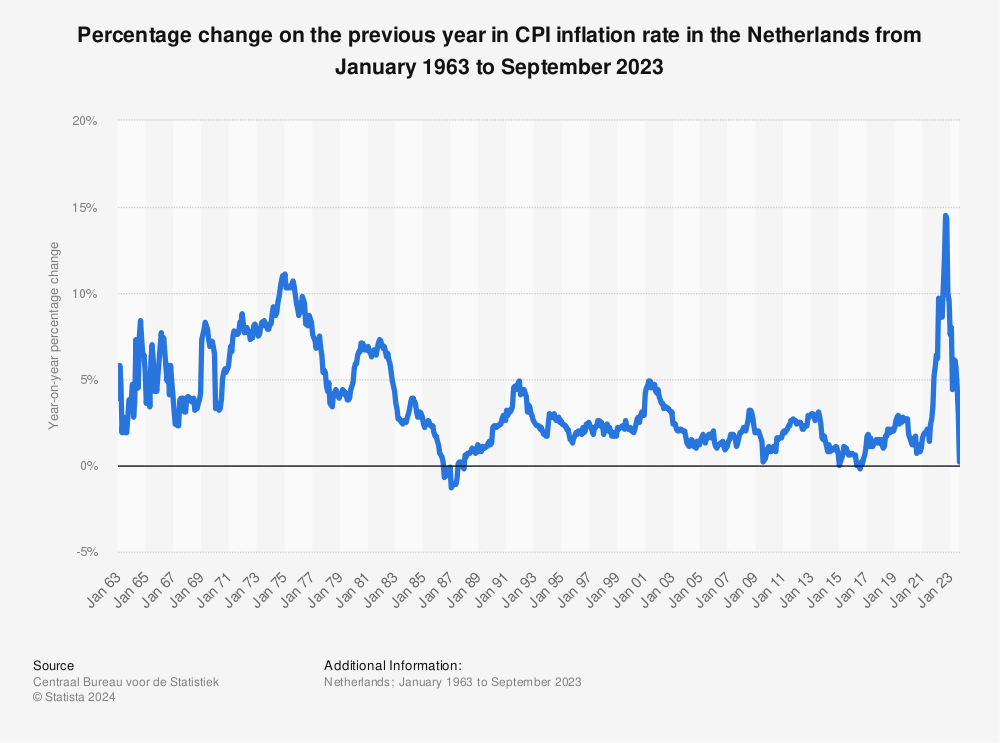

Price Growth Hit Its Peak But Dutch Housing Market Is Far From Cooling Down Raboresearch

2022 Simple Federal Tax Calculator.

. The following updates have been applied to the Tax calculator. Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your personal tax questions. You must meet all requirements before you are eligible to receive benefits.

The European Pillar of Social Rights sets out 20 key principles and rights to support fair and well-functioning labour markets and welfare systems. With low unemployment rates and a huge variety. Person 1 Husband Earned Income.

Enter the amount you earned before taxes were deducted for the. Deferred compensation contribution limit increased. 2022 Tax Brackets Due April 15 2023.

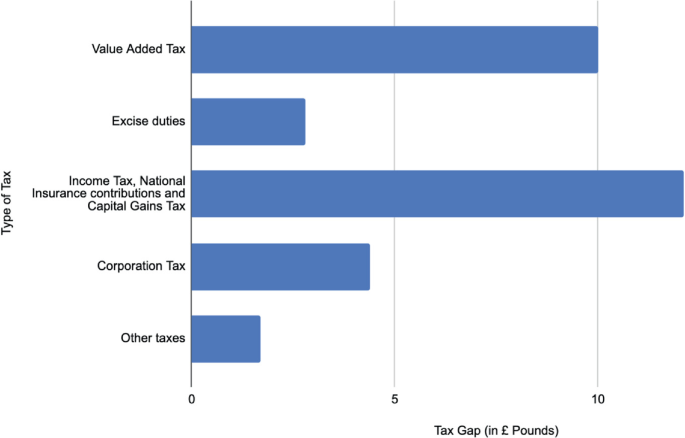

From 2023 this health and social care levy element will be separated out from other national insurance contributions and the exact amount employees pay will be visible on their pay slips or tax returns. Quickly Estimate 2022 Personal Income Taxes 2023 Income Tax Refunds. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023.

Offer period March 1 25 2018 at participating offices only. The Minnesota State Tax calculator is updated to include. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

The latest Federal tax rates for 202223 tax year as published by the IRS. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first 7000 of each.

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. Calculating 2022 Marginal Tax Brackets for IRS Payments Due April 17 2023. Return filed in 2023 2021 return filed in 2022 Income.

After July 15 2023 you will no longer be able to claim your 2019 Tax Refund through your Tax Return. Tax calculations allow for Tax-Deferred Retirement Plan. Shared-cost tax based on costs from the previous year for benefit payments that cant be attributed to specific employers.

The business stops paying SUTA tax on Barrys wages once he makes 7000 which happens in the middle of Q2. Enter your filing status income deductions and credits and we will estimate your total taxes. Dividend tax rates will rise by.

To qualify tax return must be paid for and filed during this period. The flat social tax is capped at 050 for 2021 050 for 2022 075 for 2023 085 for 2024 and 090 for 2025. UK Tax Rates for 2022 2023.

2022 Marginal Tax Rates Calculator. Use our UK salary calculator to find out how much you really earn. The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States.

Americas 1 tax preparation provider. Take into account min. As Barrys employer you remit 150 of SUTA taxes at the end of March and 60 at.

Please note this calculator is for the 2022 tax year which is due in April 17 2023. The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States. The German Annual Income Tax Calculator for the 2022 tax year is designed to provide you with a salary payroll and wage illustration with calculations to show how much income tax you will pay in 202223 and your net pay the amount of money you take home after deductions.

Updates to the Nebraska State Tax Calculator. The following updates have been applied to the Tax calculator. Enter your filing status income deductions and credits and we will estimate your total taxes.

Here is a look at what the brackets and tax rates are for 2022 filing 2023. Updates to the Colorado State Tax Calculator. UK Income Tax excl.

May not be combined with other offers. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. Benefits Calculator When will you file for Unemployment Benefits.

Updates to the Arizona State Tax Calculator. Self-Employed defined as a return with a Schedule CC-EZ tax form. Include Pension and Unemployment Insurance.

Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate. The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States. Delivering on the European Pillar of Social Rights.

The estimated benefits amount is an estimate only and does not guarantee that you will receive unemployment insurance benefits. The following updates have been applied to the Tax calculator. Social tax monthly rate.

In November 2021 the IRS released the new tax brackets for 2022-2023 with modest changes. 1 online tax filing solution for self-employed. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

W-2 Forms from all of your employers that you worked for in the past year. News Stories CPW issues hunting and fishing licenses conducts research to improve wildlife management activities protects high priority wildlife Head to head side by side Robby Gordons innovation is obvious at every level and the base-level packages of each UTV are packed with standard factory features that you just wont find. If youre married and filing a joint return.

Updates to the Minnesota State Tax Calculator. State law instructs ESD to adjust the flat social tax rate based on the employers rate class. The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States.

You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Ohio and. Polaris rzr decal wraps. Scotland Tax Band Tax Rate Taxable Income.

Save money on taxes and see how Income Tax and National Insurance affect your income. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Section 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for the temporary allowance of a 100 business meal deduction for food or beverages provided by a restaurant and paid or incurred after December 31 2020 and before January 1 2023.

1040 Tax Estimation Calculator for 2022 Taxes. Tax calculations allow for Tax-Deferred Retirement Plan. Take into account tax-free minimum 500 Monthly Unemployment insurance employer 08 Unemployment insurance employee 16 Funded pension II pillar.

So make sure to file your 2019 Tax Return as soon as possible. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Terms and conditions may vary and are subject to change without notice.

Designing Blockchain Based Taxation Systems A Cost Benefit Analysis Springerlink

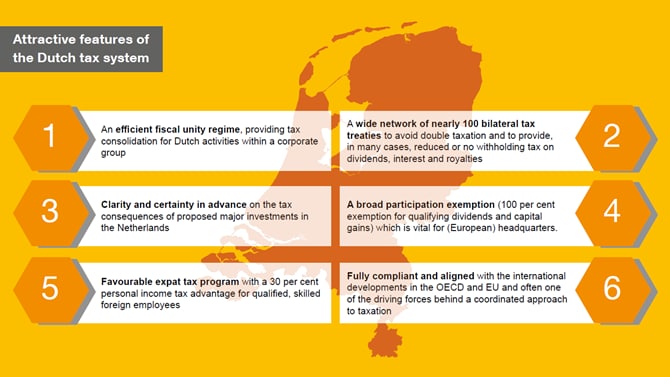

Nl Plans For 30 Ruling May Impact Significantly Kpmg Global

House Prices To Rise More Slowly Due To Interest Rate Hike And Uncertainty Raboresearch

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies

Want To Work Out Your Gross Vs Net Salary In The Netherlands Here We Ll Tell You How Page Personnel

Employment Taxes In Netherlands Boundless Eor

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

House Prices To Rise More Slowly Due To Interest Rate Hike And Uncertainty Raboresearch

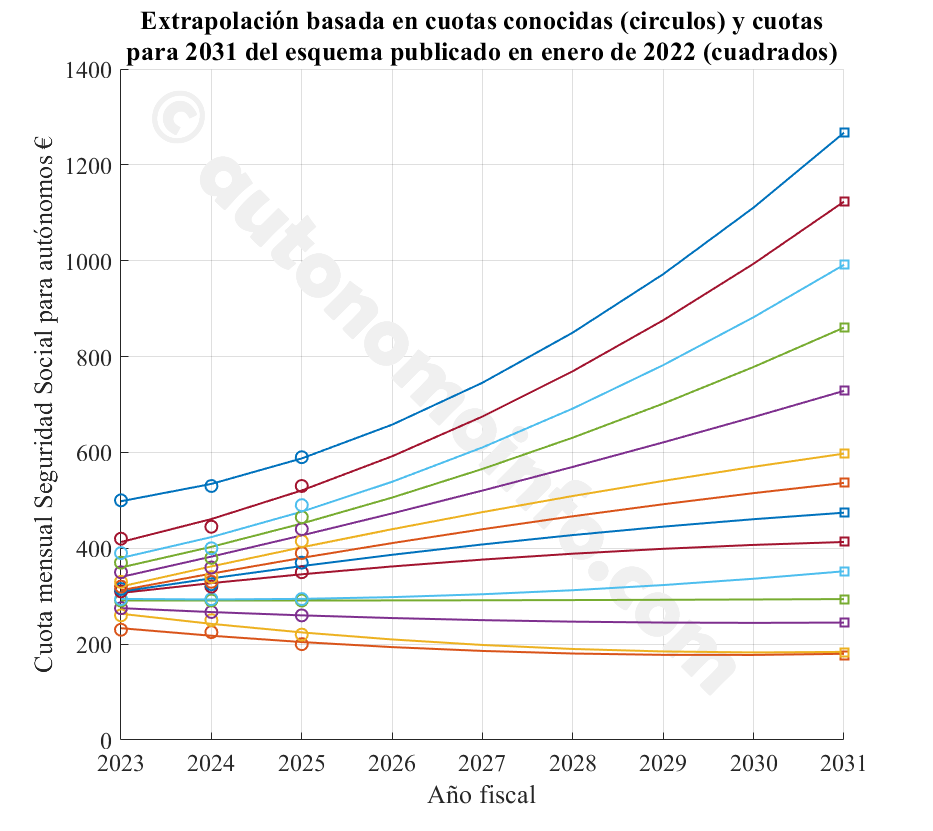

Calculate New Autonomo Quotas And Income Tax Irpf For Spain

Calculate New Autonomo Quotas And Income Tax Irpf For Spain

2

Calculate Your Tax Refund With Aangifte24

What Percentage Of A Paycheck Goes To Taxes Paycheck Tax Tax Services

Netherlands Cpi Inflation Per Month 2022 Statista

2022 Federal Payroll Tax Rates Abacus Payroll

The Optimal Industrial Carbon Tax For China Under Carbon Intensity Constraints A Dynamic Input Output Optimization Model Springerlink

Netherlands Unemployment Rate 2022 Data 2023 Forecast 2009 2021 Historical